Sep 10, 2024

Credit cards

Should I Add My Partner to My Wells Fargo Active Cash Card? Pros and Cons Explained

For most couples, the endless back-and-forth of splitting expenses through Splitwise, spreadsheets, and Venmo can be tiresome. Graduating to sharing a credit card often feels like a breath of fresh air and reduces the monthly workload.

In this blog post, we'll explore:

The pros and cons of adding your partner to your credit card

How Wells Fargo Active Cash’s authorized user card works

Why you might not see shared spending

How credit scores work

A reminder of Wells Fargo Active Cash benefits

What happens if both partners have an Wells Fargo Active Cash card

Referral benefits for your partner

Deciding between Wells Fargo Active Cash or Wells Fargo Autograph Journey

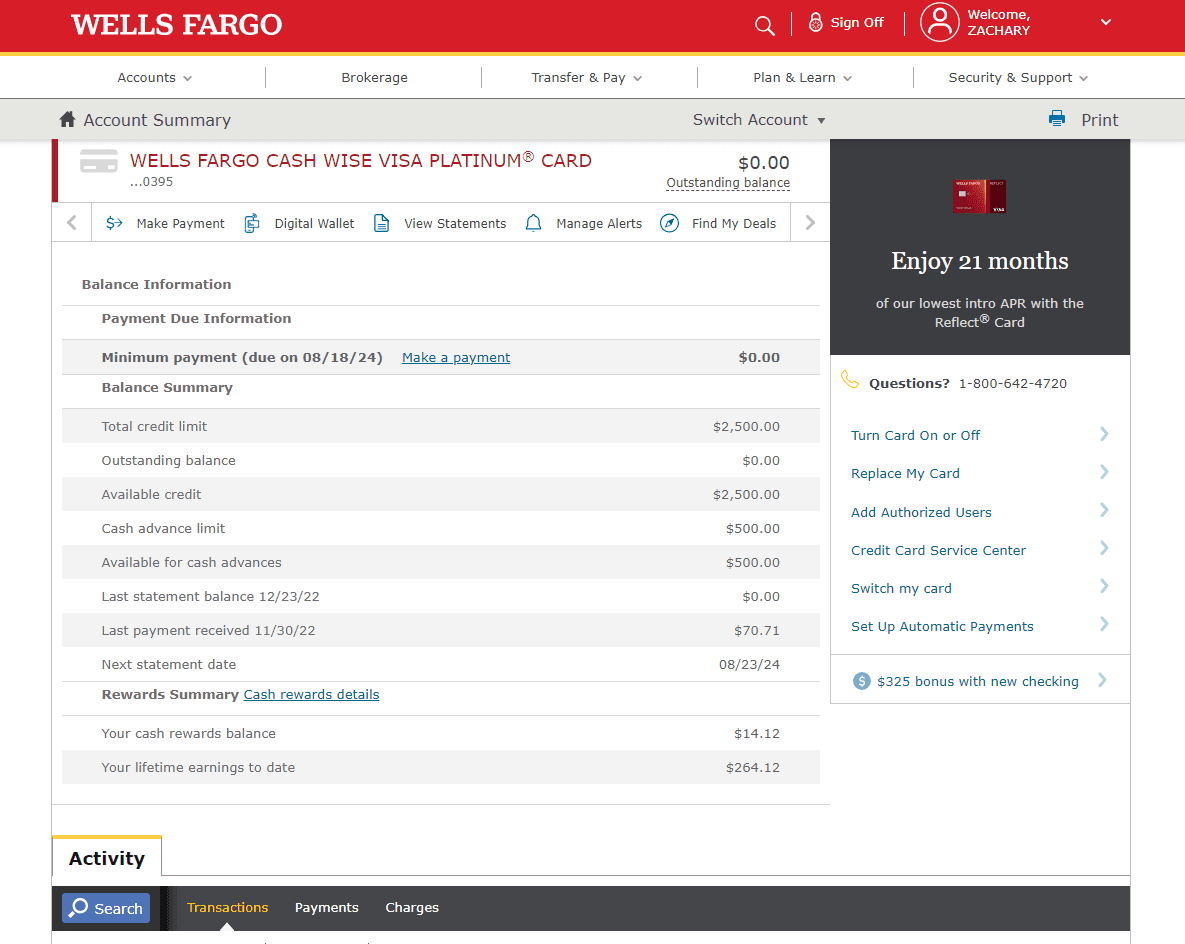

Source: Wells Fargo website as of July 2024

Options for Adding Your Partner to Your Wells Fargo Active Cash Card

For Wells Fargo Active Cash cardholders, you can add your partner (or a family member) as an authorized user for free!

Pros and Cons of Adding Your Partner to Your Credit Card

Pros:

Focus on One Type of Rewards Points: This makes it easier and faster to reach point bonuses or the required points to redeem for flights or hotel rewards.

Share Credit Card Benefits: Regardless of whether you’re using the primary card or the authorized user card, you receive the same benefits.

Cons:

Limited Spending Visibility for Additional Cardholders: Wells Fargo makes it difficult for additional cardholders to see shared spending. Plenty solves this by enabling easy connection and shared visibility.

Indirect Credit History Building: Your partner’s credit history may not build as directly, as the account will be reported to their credit as an authorized user account. While this won’t necessarily effect your credit score, lenders can see this information if they pull your credit report.

Primary Cardholder Responsibility: You are responsible for paying off the card, impacting your credit score even if the additional cardholder doesn't pay you back.

How Wells Fargo Active Cash’s Authorized User Works

When you add your partner as an authorized user, you can log into your account online and add them for free. The new card is under your account, and your partner receives a Wells Fargo Active Cash card with their name on it.

Benefits:

Faster Cash Back Accumulation: Wells Fargo Active Cash offers unlimited 2% back on all purchases. Adding your partner as an authorized user can be a great way to accumulate that cash back even faster.

Credit History Improvement: The primary cardholder's credit history could benefit the additional cardholder, since the authorized user will “inherit” the account history of the primary cardholder. This means that authorized users will see the account appear on their credit report with the same opening date and reported balance information as the primary cardholder.

Why Can I Not See Our Spending?

Wells Fargo has a limited experience for shared visibility. The authorized user setup was designed in a dated era where the primary income earner managed the credit card.

When you add your partner as an authorized user, they aren’t able to create an online account to track their spending or the spending of the primary cardholder. Traditionally, the only way to remedy this was to share login details with your partner, or wait until you receive a statement, and read through it line by line.

Solution: Plenty offers a solution by connecting your Wells Fargo account and labeling it as “shared,” providing both partners with equal visibility over shared spending.

How Do Credit Scores Work?

When you add your partner as an authorized user on your Wells Fargo account, this is how both of your credit scores will be effected:

Primary Cardholder Responsibility: As the primary cardholder, your responsibility doesn’t change much. You are responsible for paying off the card (for purchases made through the primary card and any authorized user cards). Any missed payments will impact your credit history more than your partner’s.

Credit History Building: Adding your partner can help build their credit history if the primary cardholder maintains good credit habits, since Wells Fargo reports card activity to the credit reports of authorized users over age 18. However, if the primary cardholder stops paying, that will be reflected on the authorized user’s credit report.

Tip: Your partner should maintain some cards independently to ensure their credit score stays healthy, especially if they have cards with long, good credit histories.

What If We Both Have a Wells Fargo Active Cash Card?

If both partners have an Wells Fargo Active Cash card, you’re probably best off keeping both cards, and adding your partner as an authorized user if you want to consolidate your spending onto one account. This is because the Active Cash card has no annual fee, so there are no costs associated with keeping the card open.

Advice: Instead of canceling the Wells Fargo card, just hold onto it and use it every few months to maintain the credit age on that card.

Remind Me, What Are the Wells Fargo Active Cash Benefits Again?

$0% Intro APR: 0% APR for 15 months on both purchases and balance transfers

Unlimited Rewards: Earn unlimited 2% cash back on every purchase made through the Wells Fargo Active Cash Card.

My Wells Fargo Deals: Get access to unlimited personalized deals at a wide range of merchants.

Cell Phone Protection: Get up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

What If I Refer My Partner?

Referring your partner means they’ll receive a separate hard inquiry on their credit report when they apply. Hard inquiries negatively effect your credit report. However, the effect is typically minimal, especially for those with more robust credit history. Unfortunately, at this time, there are no active referral bonuses for Wells Fargo credit card products.

How to Decide Between Wells Fargo Active Cash or Wells Fargo Autograph Journey?

For every couple, the decision depends on different factors. Key questions to consider:

Sign Up Bonus: If you can justify the annual fee, the $95 Wells Fargo Autograph Journey comes with a 60k point sign up bonus compared to the Wells Fargo Active Cash’s $200 sign up bonus.

Everyday Rewards: Depending on how much you spend on your card, you may be able to justify the $95 annual fee through the fact that the Wells Fargo Autograph Journey earns 5x points on hotels, 4x points on airlines, 3x points on restaurants and other travel, and 1x points on everything else, compared to the 2% cash back offered by the Active Cash Card.

Interested in trying Plenty out? Sign up for free today or book an onboarding call to learn more.

Sources

Johnson, Holly. Wells Fargo Active Cash Card Image. Business Insider, 24 July 2024, www.businessinsider.com/personal-finance/credit-cards/wells-fargo-active-cash-card-review.

"Wells Fargo Active Cash Card." Wells Fargo, www.creditcards.wellsfargo.com/cards/active-cash-credit-card/?FPID=0126D7IDF40000&product_code=CC&subproduct_code=AC&sub_channel=SEM&vendor_code=G&Placement_ID=71700000085077219_43700076272756810&gclid=CjwKCAjw2Je1BhAgEiwAp3KY7yWfnGUyi65PfRsQ-tj43fweZj3jsBJpZ7T3cGSG5Dfj9r-6VKnI-hoCQ8cQAvD_BwE&gclsrc=aw.ds.

"Wells Fargo Autograph Journeys Mark Card." Wells Fargo, www.creditcards.wellsfargo.com/cards/autograph-journey-visa-credit-card/?FPID=0127E1I0P10000&product_code=CC&subproduct_code=MT&sub_channel=SEM&vendor_code=G&cx_nm=CXNAME_PDCSPD&placement_id=71700000085003452_43700064609512146&gclid=CjwKCAjw2Je1BhAgEiwAp3KY77aYynFVpu1HksrtOW3VPLgfQXfbaMOKTBSnlL5oa1JQAbXWdI-KoRoCrHQQAvD_BwE&gclsrc=aw.ds.

Tsosie, Claire. “Which Credit Cards Help Authorized Users Build Credit.” Nerdwallet, 25 Aug. 2023, www.nerdwallet.com/article/credit-cards/credit-card-authorized-users-build-credit.

Kelton, Katie. “Authorized users: Everything you need to know.” Bankrate, 16 May 2024, www.bankrate.com/credit-cards/news/guide-to-authorized-users/.

About Plenty

Plenty is a wealth management platform designed specifically for couples. We go beyond budgeting, making it simple to invest, save, and grow toward your future goals by unlocking access to the financial strategies of the wealthy. Ready to get started? Sign up for free today.

Enjoying the blog? Sign up for our newsletter for the latest news and expert advice about money, relationships, and everything in between.

——

The information provided herein is for general informational purposes only and should not be considered individualized recommendations or personalized investment advice. The type of strategies mentioned may not be suitable for everyone. Each investor should evaluate an investment strategy based on their unique circumstances before making any investment decisions.

Investing involves risk, including risk of loss. Past performance may not be indicative of future results. Asset allocation, diversification, and rebalancing do not ensure a profit or protect against loss in declining markets. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Tax-loss harvesting involves certain risks, including, among others, the risk that the new investment could have higher costs than the original investment and could introduce portfolio tracking error into your accounts. There may also be unintended tax implications. We recommend that you consult a tax professional before taking action.

Plenty does not provide legal or tax advice. Where specific advice is necessary or appropriate, individuals should contact their own professional tax and investment advisors or other professionals (CPA, Financial Planner, Investment Manager) to help answer questions about specific situations or needs prior to taking any action based upon this information.

All expressions of opinion are subject to change without notice in reaction to shifting market, economic, and geo-political conditions

AUTHOR

Emily Luk

CPA, CFA - CEO and Cofounder of Plenty

Emily is the ceo and cofounder of Plenty. Started by a husband and wife team, Plenty is a wealth platform built for modern couples to invest and plan towards their future, together. Previously, she was VP of Strategy and Operations at Even (acquired by Walmart/One) and a founding team member of Stripe's Growth and Finance & Strategy teams. She began her career as a VC, and was one of the youngest nationally to complete her CPA, CA and CFA designations.

More

Credit cards

THIS SITE IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This site/application has been prepared by Plenty and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. The information contained in this site/application is superseded by, and is qualified in its entirety by, such offering materials. This site/application may contain proprietary, trade-secret, confidential and commercially sensitive information.