Jan 26, 2024

Relationships, Financial planning

A modern couple's guide to merging finances

Due to a greater focus on career, modern couples are getting married later. As a result, it is becoming more common for couples to manage their finances separately.

If you've spent the past 10 years after college or high school investing and paying the bills, combining bank accounts might feel foreign and unnecessary.

Let's delve deeper into the three main ways modern couples weave together their finances. But first, let's review old way of having a joint account versus the new way with Plenty. At Plenty, our mission is to help couples build wealth together as times change.

The Old Joint Account Option

Nearly 85% of couples end up opening a joint account around marriage, though far fewer begin exclusively using joint accounts. For most modern couples today, the joint account is a new account on top of what you each already have.

In the world of finances and relationships, joint bank accounts have long stood as a symbol of unity and shared responsibility. It's more than just a practical step; setting up a joint bank account is a symbolic bond of truly being one team.

Combining your finances in a joint bank account brings an unparalleled level of transparency into the mix. In a culture where money is the number one cause of divorce, transparency is key.

The more you both understand about each other's finances, the more you can build as a team and share your thoughts and concerns. In turn, this reduces the chances of disagreements.

That said, joint accounts aren't for all modern couples. There are downsides to opening a joint account, which include unexpected account closures and theft.

In this day and age of independence, some couples may be wary of contributing too much into a joint account at the beginning of a relationship. This is where Plenty comes in.

The New Joint Account For Modern Couples

At Plenty, we’re excited to share that we’re offering the NEW joint account. The joint account that should have existed for decades, but hasn't until now.

When you open a joint account, we ask partners to decide on a maximum withdrawal limit. We believe a healthy conversation around opening a joint account and setting withdrawal limits improves trust and understanding.

If one individual attempts to withdraw more than that amount, both partners need to login and provide authorization. In such a situation, more fruitful dialogue is conducted to further strengthen financial transparency.

Having a maximum withdrawal limit in the Plenty joint account safeguards both partners. It’s just one more example of how we’re modernizing shared finances.

A Survey Of How Modern Couples Are Merging Their Finances

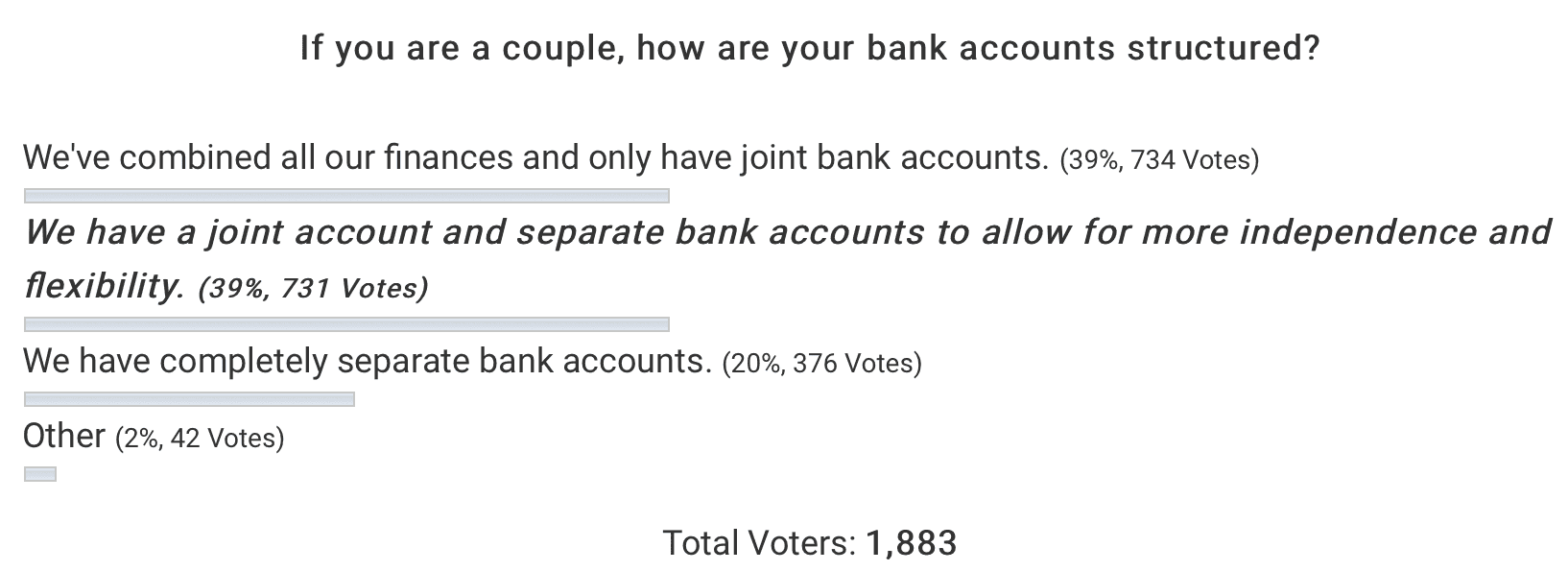

For perspective, in a 1,883-person survey conducted by Financial Samurai, a site geared towards personal finance enthusiasts, the number of couples who combined all their finances and why have hybrid finances was the same at 39% each.

Now let's look deeper at three ways in which modern couples can decide to combine their finances or not.

Merging Finances Option 1: Yours / Mine / Ours

Increasingly, this hybrid way of merging finances is the most common way that dual career modern couples choose to merge finances. Couples keep a set of their own accounts, open up a new set of joint accounts, then decide what % they keep in their individual vs. shared accounts.

Whether you have one account that's solely yours or multiple, having something of your own can foster autonomy and allow for personal spending without judgment.

Personal accounts could be a checking account where you stash 10% (or whatever floats your financial boat) of your paycheck. A credit card where you charge your treat purchases or buy presents for your partner. Or an investment account, where you like the privacy of making your own decisions. Or a safety net account like your retirement accounts.

Increasingly, modern couples with separate accounts share visibility into some of their accounts and talk transparently about where they are: independently and together. It’s finding the ‘just-right-porridge’ temp for ‘me’ and ‘we’ to both build together and feel independent.

This magical balance ensures everyone's thriving individually, bringing their A-game to the partnership. From reducing resentment to preserving the spark of romance, autonomy is the secret sauce for a resilient and vibrant marital journey. Stay tuned for more legal love wisdom!

Merging Finances Option 2: The Join-It-All Approach

This approach is most common for individuals with a single-income household structure, or couples who got married in their early twenties. Some may call this the “traditional way” of combining finances.

Only using joint accounts is waving goodbye to a certain level of financial autonomy. If you're someone who values having 100% your own financial space and decision-making power, merging accounts might feel like handing over the reins - as if you’re losing out on the freedom of financial decision making you’ve been so accustomed to for years.

At the same time, if you are the stay-at-home spouse who isn't generating income, the join-it-all way of merging finances is the best and only way. To develop a level of financial autonomy for the non-income-earning spouse, a regular dialogue needs to be had regarding spending guidelines.

A stay-at-home parent can be a full-time job equal to at least the median household income of the city of residence. Childcare hours are often far longer than the standard 40-hour workweek. Therefore, we recommend assigning a salary to the stay-at-home parent in order to crystallize the value of their work.

The Importance Of Setting Financial Guidelines

Money can be a touchy subject, and fully joining your finances may create new, unexpected pressures. Deciding on spending habits, budgeting priorities, and financial goals can sometimes lead to heated discussions or unwanted tensions.

Unraveling fully joined finances can also be a complex process if the relationship hits a rough patch, especially without a prenup. If the marriage ends in divorce, and you do not have a prenup, untangling joint assets and debts can add an extra layer of stress to an already challenging situation.

In our experience, more modern couples are shying away from the traditional join-it-all approach. However, you certainly know your relationship best, and a join-it-all approach to merging finances can certainly work.

Merging Finances Option 3: The What’s Yours-Is-Yours Approach

This approach is most common for individuals who highly value financial independence. There is no merging of finances. About 15% of modern couples use this approach and it’s most common amongst couples who each independently have a high net worth.

This option provides the most independence and autonomy - each individual continues deciding how they spend, save, or invest. They can choose to share details with their partner when they choose, if they choose.

The separate approach to merging finances is usually the trickiest if you’re actively working towards financial goals together… planning for a house? Kids? It adds more layers for coordination and communication.

This option is most common for couples who don’t have as many shared or intermingled goals (ie. couples getting married later in life, who may not be planning for kids or already own a home, who are happy cohabitating and not getting married).

Over time, as new financial goals emerge, opening a new joint account with Plenty for collaboration is an option.

Modern Couples Are Dynamic With Their Finances

In the ever-evolving landscape of modern relationships, there is no one-size-fits-all approach to merging finances. Whether you opt for the all-joint-accounts route, prefer 100% financial independence, or choose a hybrid approach, the key is open communication and a shared understanding of your financial goals.

Modern couples are increasingly becoming more dynamic when it comes to managing their finances. As a result, it's important for couples to use equally dynamic wealth management tools to help achieve their financial goals.

If you and your partner are actively navigating how to merge finances, Plenty was built with your financial situation in mind.

With Plenty You Can:

Link your separate accounts and get a bird's-eye view of your combined financial picture; flexibly setting accounts as shared or private

Invest and save towards shared goals like weddings, a downpayment, kids, or retirement

Track your shared and individual spending

Manage your shared net worth over time

And much more!

About Plenty

Plenty is a wealth management platform designed specifically for couples. We go beyond budgeting, making it simple to invest, save, and grow toward your future goals by unlocking access to the financial strategies of the wealthy. Ready to get started? Sign up for free today.

Enjoying the blog? Sign up for our newsletter for the latest news and expert advice about money, relationships, and everything in between.

——

The information provided herein is for general informational purposes only and should not be considered individualized recommendations or personalized investment advice. The type of strategies mentioned may not be suitable for everyone. Each investor should evaluate an investment strategy based on their unique circumstances before making any investment decisions.

Investing involves risk, including risk of loss. Past performance may not be indicative of future results. Asset allocation, diversification, and rebalancing do not ensure a profit or protect against loss in declining markets. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Tax-loss harvesting involves certain risks, including, among others, the risk that the new investment could have higher costs than the original investment and could introduce portfolio tracking error into your accounts. There may also be unintended tax implications. We recommend that you consult a tax professional before taking action.

Plenty does not provide legal or tax advice. Where specific advice is necessary or appropriate, individuals should contact their own professional tax and investment advisors or other professionals (CPA, Financial Planner, Investment Manager) to help answer questions about specific situations or needs prior to taking any action based upon this information.

All expressions of opinion are subject to change without notice in reaction to shifting market, economic, and geo-political conditions

AUTHOR

Emily Luk

CPA, CFA - CEO and Cofounder of Plenty

Emily is the ceo and cofounder of Plenty. Started by a husband and wife team, Plenty is a wealth platform built for modern couples to invest and plan towards their future, together. Previously, she was VP of Strategy and Operations at Even (acquired by Walmart/One) and a founding team member of Stripe's Growth and Finance & Strategy teams. She began her career as a VC, and was one of the youngest nationally to complete her CPA, CA and CFA designations.

More

Relationships, Financial planning

THIS SITE IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This site/application has been prepared by Plenty and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. The information contained in this site/application is superseded by, and is qualified in its entirety by, such offering materials. This site/application may contain proprietary, trade-secret, confidential and commercially sensitive information.